In our previous blog post, ‘What is Profit First?’, we establish that Profit First is not only a book written by Mike Michalowicz, but also a groundbreaking financial methodology that ensures your business will not lose profits, no matter its size or industry. But you may still be wondering, how does Profit First work?

In this post, we will cover why modern business owners, entrepreneurs, accountants, bookkeepers, and coaches should be using Profit First, and how to be proactive rather than reactive with your money. You will also learn about Profit First percentages, and how to use the Profit First Instant Assessment. Read on to change your life and grow your business.

The Profit First methodology is an established money management technique for businesses of all sizes, from all industries. The technique prioritises profits over expenses, creating sustainable income and profit. It helps business owners get out of debt and addresses unhelpful money management habits enabling business growth. Profit First gives clarity on business budgeting by stabilising cash flow and reducing the ‘feast-to-famine’ cycle.

Profit First improves your cash flow by prioritising profits over expenses. The multiple bank account system ensures that your profits do not decrease because they have been separated from money that is available for expenses. It’s simple, yet incredibly effective.

Business profits are traditionally calculated by taking expenses away from sales, like this:

SALES – EXPENSES = PROFITS

However, with the Profit First method, the equation becomes focused on calculating expenses, like this:

SALES – PROFITS = EXPENSES

This outlook adapts to the inevitable human behaviour of spending what we assume is available, rather than the profitable approach of separating the profits that we actually have. By adapting your habits to better suit your behaviour so you can improve cash flow.

Profit First operates by altering human behaviour surrounding money management from reactive, to proactive. Contemporary human nature is ingrained with the habit of using a resource in its entirety, until more of that resource is given to us again. Unfortunately, when this reactive behaviour enters our financial management habits, it can lead to debt, burnout, and even business closure.

By implementing Profit First into your money management, you will transform your behaviour from reactive to proactive. To be proactive is to create or control a situation rather than responding to it after it has happened. With Profit First, you create and control the profits from your business by separating your money into different bank accounts with specific purposes. Instead of being reactive and overspending, you now take note of what money is available for each financial aspect of your business. All of your money is accounted for with a specific purpose, leaving no room for overspending.

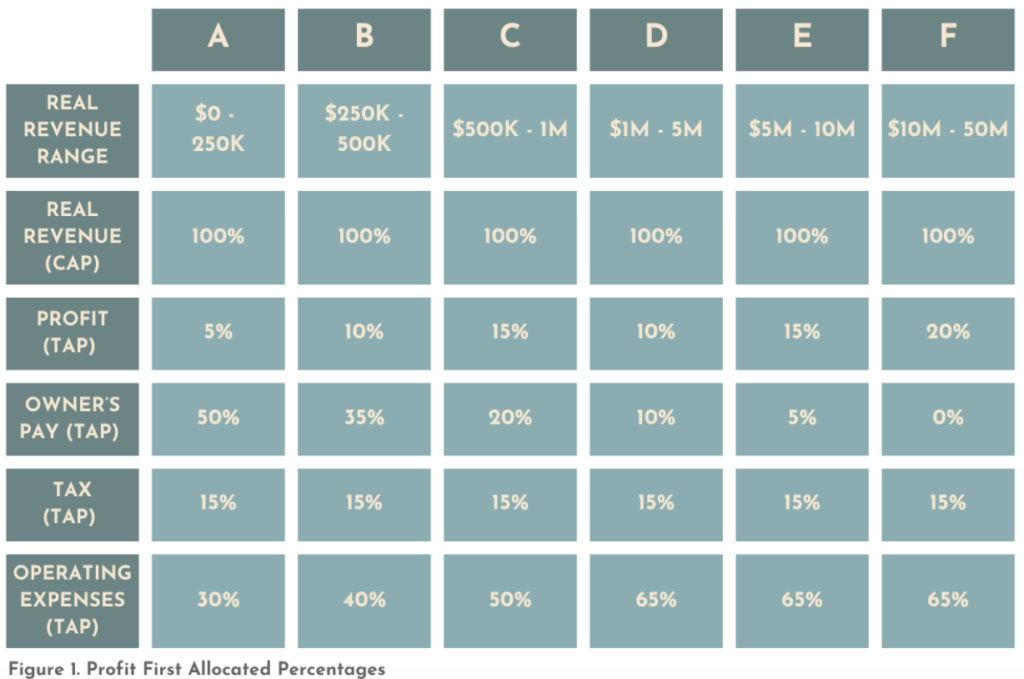

The Profit First Percentages provide you with an outlook of what your current financials look like, and how to move towards your future business goals in an organised fashion. Profit First uses two types of percentages – CAPs (Current Allocated Percentages) and TAPs (Target Allocated Percentages). CAPs represent how your current finances are split between profit, tax, owner’s pay, revenue and operating expenses. TAPs represent your goals and allow you to see more profitability and greater cash flow. Profit First provides resources to calculate your CAPs which will highlight potential problems in cash flow and pricing. Once you address where your problems lie, you can establish realistic goals and financial foundations that are essential to determining your TAPs. The Profit First book provides a general guide to what your TAPs should be. Below is an outline of Profit First founder Mike Michalowicz’s general TAP allocations.

These calculations are a general outline, as your TAPs will be determined by factors unique to your business including your current debt, amount of employees/contractors, industry or niche-specific intricacies, and/or business structure differences. We can help you to calculate the most efficient TAPs specific to your business. Get in touch with Profit First Accounting & Coaching.

Once you know your TAPs, you can distribute your finances between the allocated bank accounts. This money distribution is the basis of preparing your business for sustainable business growth and cash flow, and eradication of debt. You can read more about Profit First percentages in the Profit First book (which you can buy from our shop, here ).

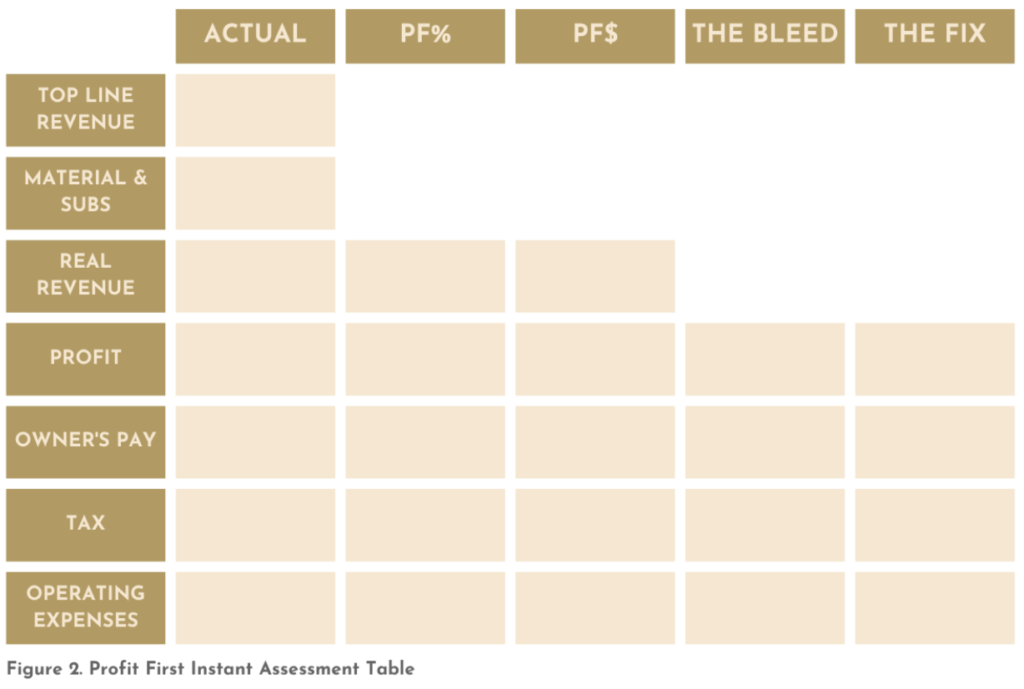

The Profit First Instant Assessment is a simple worksheet that tells you what you need to do with the Profit First allocation of money in your business (either Increase or Decrease Profit First percentages) and by how much. You can find the free download here. The Instant Assessment requires you to take the allocated percentages from Figure 1 (above) that best suit your business and then fill out Figure 2 (below) to discover which of your business costs need to be increased/decreased (the fix).

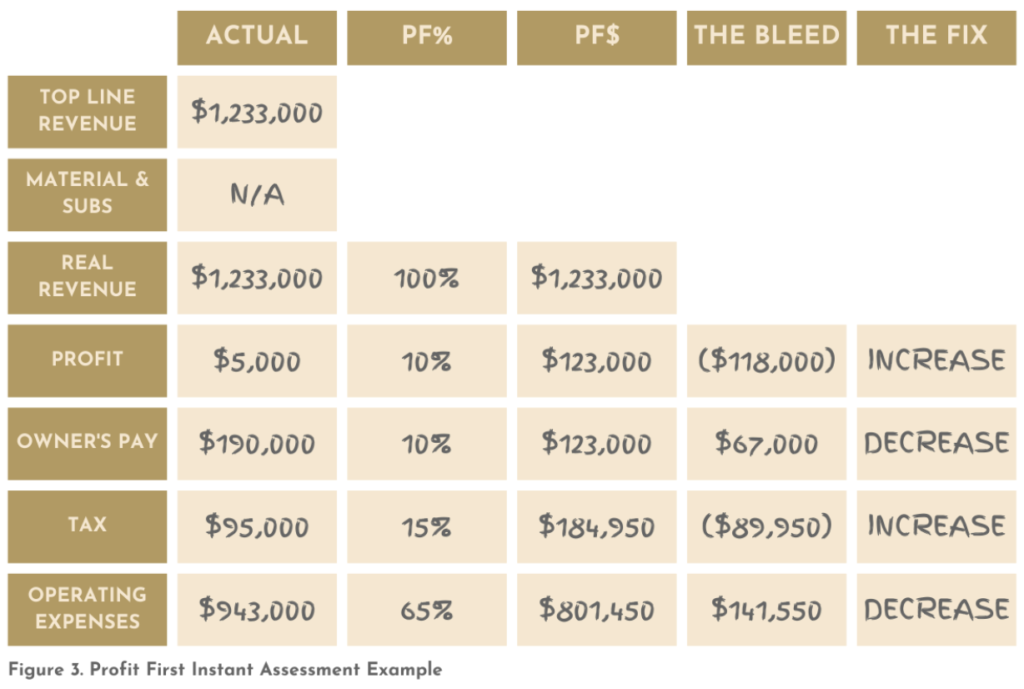

Once your instant assessment is complete, it should look something like this:

The Instant Assessment pdf comes with easy-to-follow instructions for filling out your own copy. If you need further help, get in touch through our contact page.

Profit First is a life-changing financial management methodology. It creates sustainable income and profit through regular and calculated management of your revenue, pricing, and expenses. By regularly allocating your finances to the designated bank accounts, you ensure that your debts are paid, the business owner is paid, expenses are kept under control, tax and GST are accounted for, and most importantly, your business is operating at a profit. Using the allocated bank accounts and understanding your CAPs and TAPs means that you will consistently see regular growth in your profit account, have ample funds to pay your tax and GST bill on time, see your debts snowball into reduction, and have definite finances for paying your expenses, dues, and yourself. Profit First makes sure that you run your business, instead of your business running you.

Now that you know how Profit First works, it’s time to get started. You can purchase the book from our online store, and download the Instant Assessment to see how Profit First will be able to help your business grow. And when you’re ready, contact us by calling 03 5979 2671 or book a free consultation online, here. You can also follow us on Instagram (@profitfirst_accounting) and Facebook (@ProfitFirstAccounting) to stay up to date.

4.8 Rating

Building a profitable business is not an overnight success;

it’s a journey of consistent efforts and strategic financial management. In the world of entrepreneurship, profit isn’t just a destination; it’s a perpetual path.

-Mike Michalowicz

Ready to revolutionise your business's financial approach? Join us on a journey to financial success by embracing the Profit First Methodology. Partner with us now and pave the way for a brighter financial future.

Special Offer: Register now for just $98 (normally $330)!

1st Masterclass Session: Thursday, 07 Nov 2024