Did you know that small and micro businesses have an average tax debt of $80,000? A recent study by the University of New South Wales Tax and Business Advisory Clinic revealed the tax debts of small and micro business clients requesting assistance.The study also found that the average micro business to visit the clinic has eight years of overdue tax returns and that over one third of the UNSW clients rate their financial stress levels at the maximum threshold. (Source) . Potential causes of this financial distress include failure in understanding one’s tax obligations, family breakdowns and personal issues, and the absence of the Profit First methodology.

The Profit First methodology is an established money management technique for businesses of all sizes, from all industries. The technique prioritises profits over expenses, creating sustainable income and profit. Profit First operates by altering human behaviour surrounding money management from reactive, to proactive based upon Parkinson’s Law. By adapting your habits to better suit your behaviour, you not only improve cash flow but also pay down your debts.

The Profit First methodology takes a strategic approach to reduce your debts constantly, ensuring you avoid distressing financial situations. Start with a one-time setup by opening the allocated bank accounts for Profit First. Learn more about the different accounts required for Profit First bank balance accounting in our blog post, ‘Profit First: Transforming Your Business for Guaranteed Profitability’. Use the profit account to pay down your debt. Allocate up to 99% of the Profit Account to your debt to help pay it down (minimum repayments come from the OpEx account), and keep the remaining 1%.

The next step is to determine your Profit First percentages and ensure they function correctly. Profit First uses two types of percentages: CAPs (Current Allocated Percentages) and TAPs (Target Allocated Percentages). CAPs show how you currently split your finances between profit, tax, owner’s pay, revenue, and operating expenses. TAPs represent your goals and allow you to see more profitability and greater cash flow.

Start separating your finances by setting money aside for tax, owner’s pay, expenses, and profits. Setting your GST aside now will ensure it’s available for the next quarter. You can then utilise your profits account to pay down your debt each financial quarter. We refer to this concept as the debt snowball.

You can read more about Profit First percentages and learn how to use the Profit First Instant Assessment worksheet in our last blog post, ‘How Does Profit First Work?’. Start separating your finances by setting money aside for tax, owner’s pay, expenses, and profits.

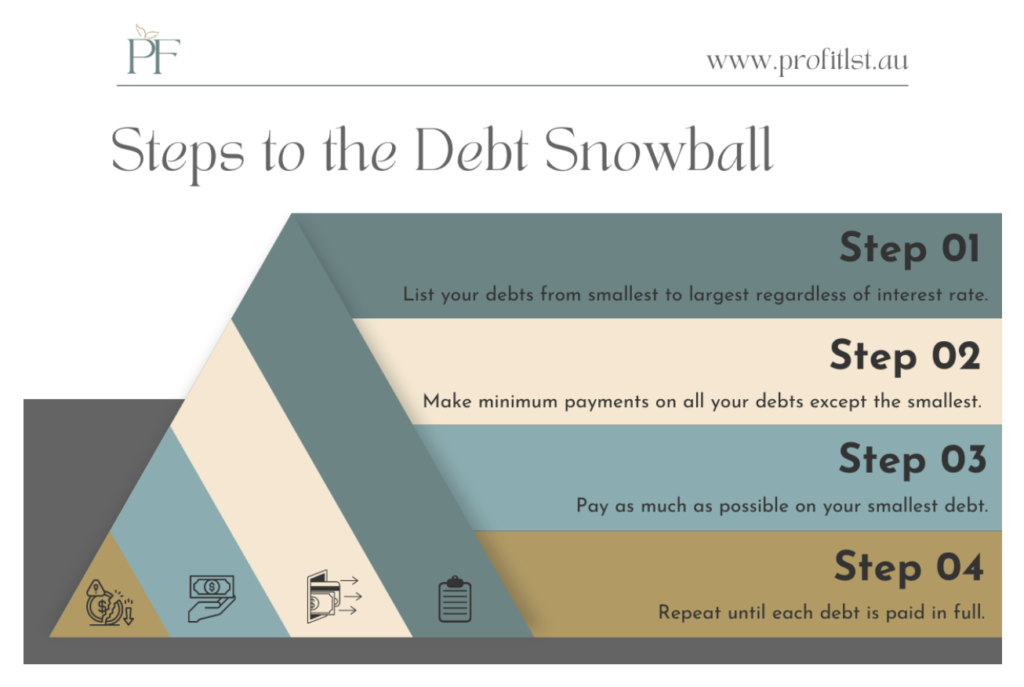

Profit First utilises the debt reduction method, ‘The Debt Snowball’ in combination with multiple accounting banking to guarantee that your debt is diminished. The Debt Snowball approach involves listing your debts from smallest to largest and prioritises paying them off in the same order. The focus becomes paying off your smallest debt whilst paying minimum payments on all others, until the smallest debt is gone. This process is repeated until all debts are paid off. This approach reduces your financial stress and builds confidence by starting small before approaching the most intimidating debts.

Profit First provides a variety of resources to help you pay off your debts. These resources include tools such as the Debt Snowball Calculator that allows you to input all of your debt and then work out the most cost-effective way to eliminate your debt using various strategies. It is also important to contact your bank regarding lowering interest rates to enhance Profit First debt reduction.

It is important to remember that once you have a repayment plan with the ATO, you must pay future tax bills when they are due. This means that your future bills cannot be added to your previous debt. So, you need to resolve the issue of ever-growing tax bills, and then tackle the debt. Profit First and The Debt Snowball is the perfect solution.

Profit First is a revolutionary financial management system that stabilises cash flow and reduces the ‘feast-to-famine’ cycle no matter the size or industry of your business. Book a call with Profit First Accounting & Coaching and we can work out a plan to eliminate your debt. Get in touch.

4.8 Rating

Building a profitable business is not an overnight success;

it’s a journey of consistent efforts and strategic financial management. In the world of entrepreneurship, profit isn’t just a destination; it’s a perpetual path.

-Mike Michalowicz

Ready to revolutionise your business's financial approach? Join us on a journey to financial success by embracing the Profit First Methodology. Partner with us now and pave the way for a brighter financial future.

Special Offer: Register now for just $98 (normally $330)!

1st Masterclass Session: Thursday, 07 Nov 2024