Determining whether you are an employee or a contractor can be more difficult than it sounds. There are many convoluted myths which have led to confusing your role as an employee for that of a contractor. It is important to understand the differences between employees and contractors as the differing roles will determine the classification of your working engagement.

Contractors (including independent contractors and subcontractors) run their own business and sell their services to others. Contractors will often use their own processes, tools and methods to complete their work. They may negotiate their own fees and working arrangements, and can work for more than one client at a time. Contractors do have workplace rights and protections but have different responsibilities relating to insurance, tax and super. (Source).

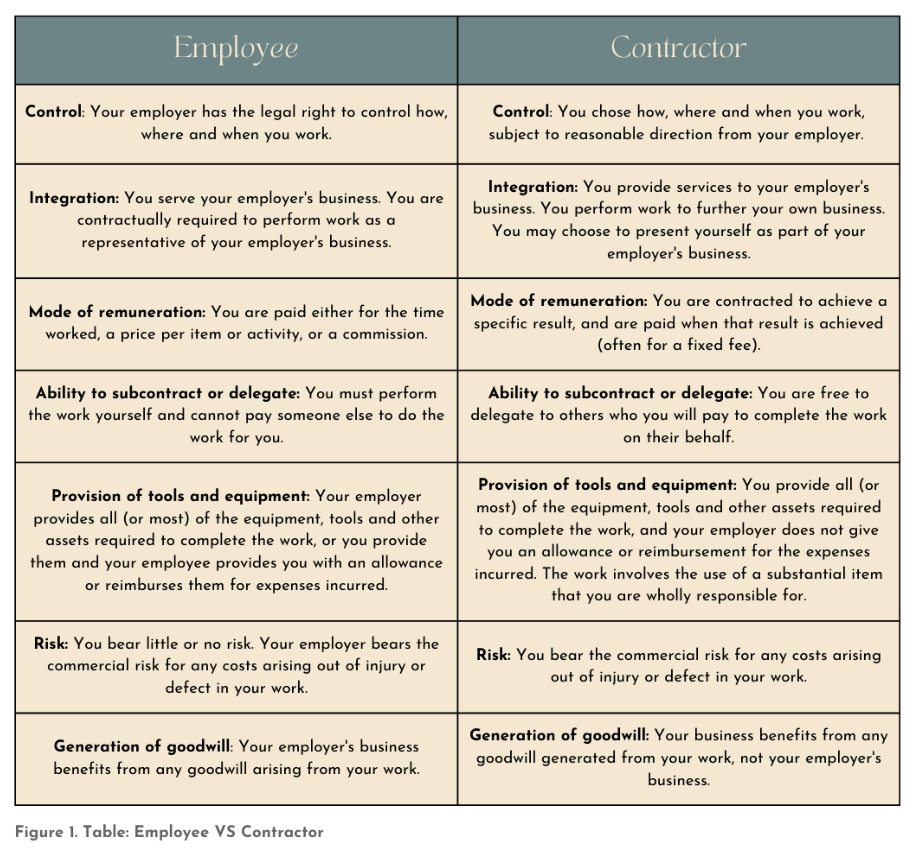

To establish whether you are an employee or contractor, you need to establish whether you are serving the business (employee) or running the business (contractor). You can do this by reviewing the legal rights and obligations in the contract you entered into.

An employee serves the business that has hired them, and their work acts as a representation of that business. For example, you are hired by a hairdresser and serve the clients of the hairdressing business. Your hours are determined by the business owner, the business provides all of your tools, eg scissors, colours.

Alternatively, an independent contractor provides services to the business that has hired them and performs work to further their own business. For example, a busy salon is after an extra experienced hairdresser one day a week. You also work in another salon 3 other days a week. In order to share the costs of rent, they offer you a chair in the salon for one day a week. You specialise in bridal hair, so only work Saturdays. You determine your own hours, you can source your own clients and you provide your own tools for the work you do.

The table below provides an outline of indicia and features that may indicate whether you are an employee or a contractor, but no single feature is definitive. (Source).

There are certain circumstances in which the employer must pay superannuation for contractors who are deemed to be employees for superannuation purposes. These circumstances include the following:

What does this mean for labour hire workers? A labour hire agency may hire a labour hire worker as either an employee or contractor. The agency is responsible for providing their employees with employment entitlements such as leave. An employer that engages with a labour hire worker will pay the agency a fee for their services.

We hope this article has helped you to determine whether you are currently working as an employee, or as a contractor. If you are a contractor, we highly recommend that you engage with Profit First for Contractors. Read more in this blog.

If you have any questions, don’t hesitate to contact us by calling 03 5979 2671 or book a free consultation online, here.

4.8 Rating

Building a profitable business is not an overnight success;

it’s a journey of consistent efforts and strategic financial management. In the world of entrepreneurship, profit isn’t just a destination; it’s a perpetual path.

-Mike Michalowicz

Ready to revolutionise your business's financial approach? Join us on a journey to financial success by embracing the Profit First Methodology. Partner with us now and pave the way for a brighter financial future.

Special Offer: Register now for just $98 (normally $330)!

1st Masterclass Session: Thursday, 07 Nov 2024