Why Should I pay An Accountant To Do My Tax Return?

Hiring an accountant for your tax return simplifies the process, ensures compliance, maximises deductions, and is tax-deductible. Learn how it benefits you and your business.

Retailer or wholesaler? This is the advice your business needs…

Are you a retailer or wholesaler? Whether you are online in the ecommerce realm or have a bricks and mortar store the challenges faced are similar. Perhaps you are in B2B (business to business) sales, or maybe B2C (business to consumer), you could be part of a very niched space like the healthcare equipment and supplies industry, or a home garden and tools supplier. The fact is, whatever industry you serve as a retailer or wholesaler the basic principles of good business behaviour are universal, and in this article, you will receive some valuable business tips on how to run a tight ship and maximise your profits.

There are many challenges for wholesalers and retailers at the moment including the pressure that interest rates are still playing in the economy (and according to top economists it looks like they will continue to do so well into next year), supply chain issues as well as a decline in customer spending but an increase in supply costs. According to a recent KPMG report, Quarter 3 of 2023 Producer Price Index recorded the highest rate of growth in production costs since the same quarter last year, while margins were impacted by a weakened Australian dollar and strong annual wage growth. In this market retailers and wholesalers should priortitise customer retention rather than new customer acquisition (hello loyalty programmes!).

One of the main pressure points for retailers and wholesalers that I encounter is managing inventory and in particular cash flow around it. This is particularly evident in seasonal businesses, such as Christmas suppliers, return-to-school products, confectionery suppliers at Easter etc… The trick is to manage your stock and your cash flow simultaneously and meticulously. Now, this isn’t meant to scare you or put you off, I have a tried and tested system that once implemented will change your life completely. Goodbye, sleepless nights worrying about where the secret stash of cash is going to come from to secure the stock you need… read on…

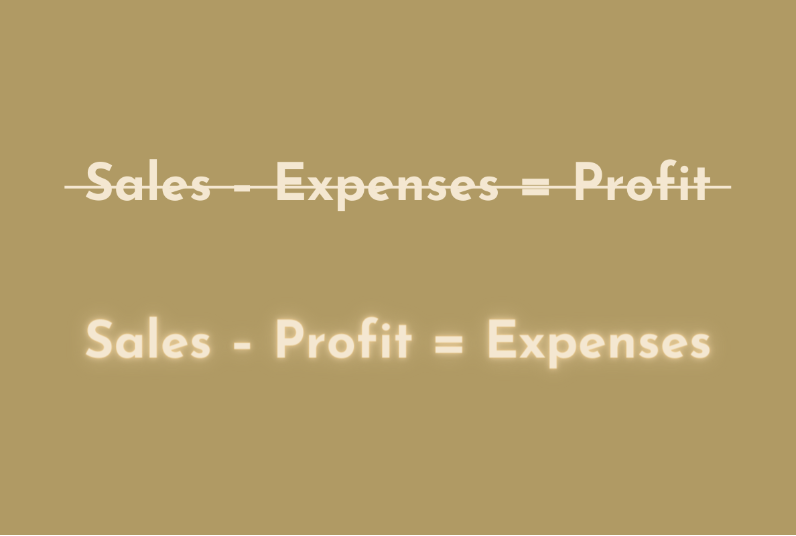

Let me introduce to you my secret weapon… Profit First. Profit First is the game-changing money management system of serial entrepreneur and author Mike Michalowicz. It challenges traditional accounting practices making profit the goal, and not the ‘bit left over’.

To implement Mike’s system correctly into your retail or wholesale business, you need to open up six (6) key bank accounts.

So, once these accounts are set up, any money that comes into your income account is then distributed to each other account according to a specific percentage that will work for your business. Read more about Target Allocated Percentages here, or give us a call and we can assist you in calculating the right percentages for your business.

Here is where the magic happens. Once you have started allocating money into these separate accounts you now have the money sitting there waiting for you. You know exactly how much is available for each business expense. This allows you to keep track of the inventory expenditure as well as to ensure that your pricing is correct. Another advantage of having your budget set out in varying accounts this may also open up opportunities to receive better pricing if paying upfront for goods, rather than on account for example. This puts you in the driver’s seat when negotiating better terms with your procurement. It also ensures that you are not chasing your tail when it comes to managing cash flow.

As a mastery-level certified Profit First Professional, I know all the strategies you need to keep on top of your business finances, for seasonal businesses we may also recommend setting up a drip account. In theory, this is an extra account that we allocate money to in peak season, and then slowly drip-feed our expenses and inventory account as needed. This practice ensures that money is available to you when needed, and eliminates the temptation of spending money on unnecessary items.

If this sounds like the system you need to help your business to not only survive but to thrive, then book a discovery call with me today.

4.8 Rating

Building a profitable business is not an overnight success;

it’s a journey of consistent efforts and strategic financial management. In the world of entrepreneurship, profit isn’t just a destination; it’s a perpetual path.

-Mike Michalowicz

Ready to revolutionise your business's financial approach? Join us on a journey to financial success by embracing the Profit First Methodology. Partner with us now and pave the way for a brighter financial future.

Hiring an accountant for your tax return simplifies the process, ensures compliance, maximises deductions, and is tax-deductible. Learn how it benefits you and your business.

Learn how Profit First can maximise profits and streamline operations for retailers and wholesalers in the healthcare equipment and supplies industry. Discover effective strategies for cash flow management, inventory control, and customer retention. Overcome challenges such as supply chain issues and declining customer spending with proven business finance tips. Take the first step to financial stability and growth by implementing Profit First today.

Master your Profit First percentages for business success with our expert guidance and tailored strategies. Our certified professionals ensure a seamless implementation, adjusting allocations to fit your unique needs and industry demands. Stay agile and profitable with regular reviews and tweaks, maximising your financial potential. Book a call today and step into the power of Profit First for sustainable growth and prosperity.

Discover the transformative power of Profit First methodology as we delve into the differences between traditional accounting methods and a profit-centric approach. Explore how prioritising profit can revolutionise your business finances and set you on a path to sustainable growth and success.

Discover the rare breed of accountants who embrace the Profit First methodology and can revolutionise your financial strategy. Learn why finding the ideal Profit First Certified Accountant is essential for optimising your business’s profitability and success.

Discover the ins and outs of trusts in Australia. Learn about the different types of trusts, their benefits, and how an accountant can assist you in setting up a trust for your family or business.