So you are interested in implementing Profit First into your business but have come a little unstuck when it comes to understanding your percentages. Do not stress. As a Mastery level certified Profit First Professional, I can assist you.

Of course, each business is different, and therefore working out your percentages for distribution will vary. Although the methodology of Profit First can be universally implemented into any business in any industry, it is not a straight one-size-fits-all approach. Tweaks are necessary to ensure that your business is operating to its fullest potential, meeting your individual goals and making maximum profit!

Step one in the process is to ensure you have opened up your five (5), sometimes six (6) bank accounts.

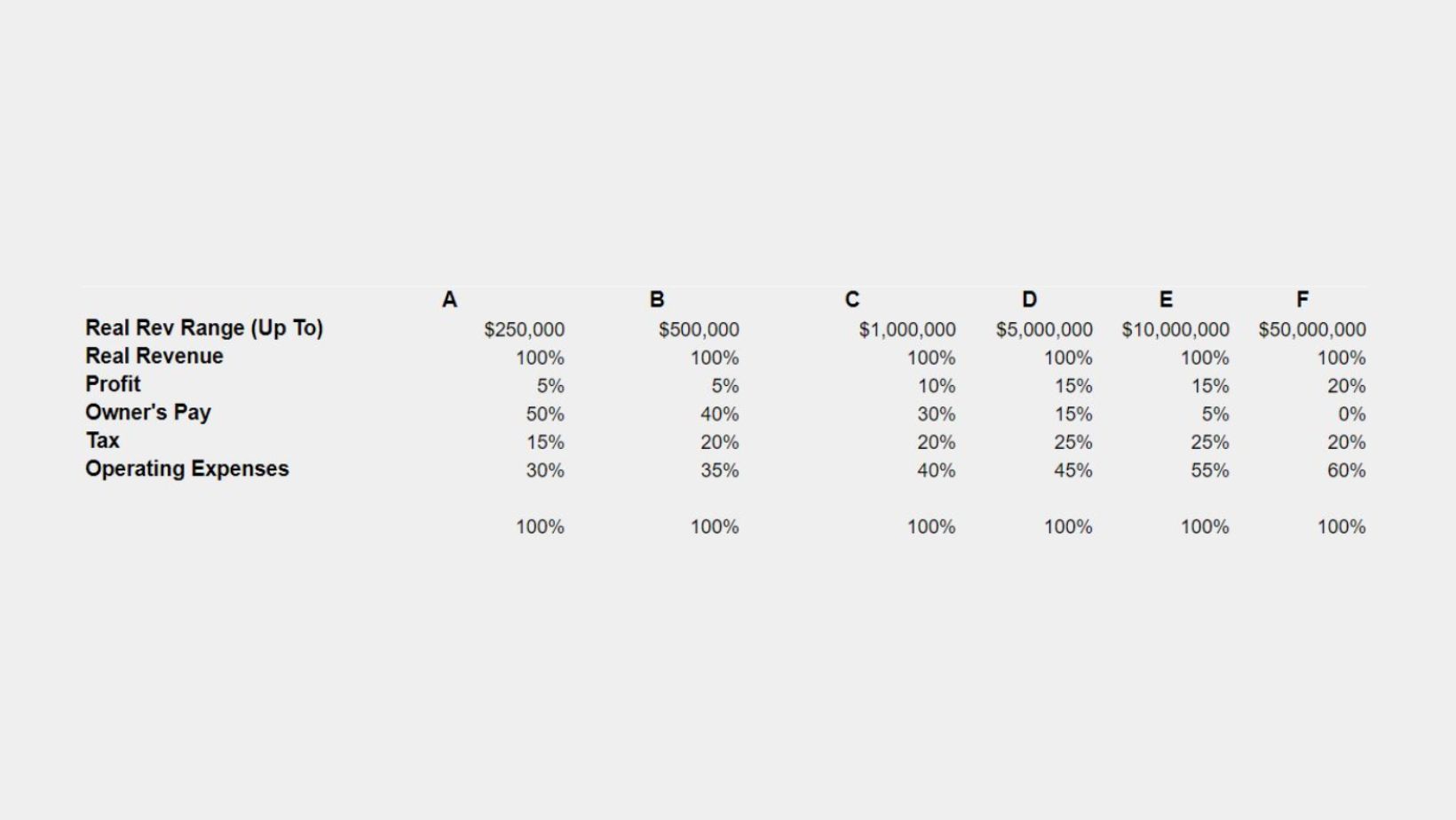

As all the money coming into your business is deposited into the Revenue Account, you then need to distribute it to the other accounts. Following this process ensures that you have money ready to use when needed for the exact purpose that the money has been set aside for. As a general rule, you can follow these allocations below:

As mentioned this may vary from business to business and depending on the industry, for example, a trade business may have significant expenses for their tools, trucks and equipment, whereas a Marketing consultant may have minimal expenses mainly a laptop and subscriptions, they might even work from home, not needing rent. The percentage allocation would need to reflect this. The difference can then be allocated to another area to meet the ongoing goals of the business.

As mentioned earlier, Profit First is a simple concept and it can be implemented into any business in any industry. However, there can be complexities and as a Profit First Professional and an accountant, I am an expert when it comes to bespoke implementation. Some people feel that Profit First is limiting and it won’t work for their business. However, the percentages in the book are just a starting point. To get the maximum benefit from Profit First, you need to have a customised plan for your business that will meet your individual goals and needs.

Should your business be in debt when you are starting out with Profit First, we can also introduce strategies to combat the debt (read more about Profit First and debt solutions, here). Your allocations may also need to be adjusted to ensure that repayments are being accounted for.

After your allocations have been determined and you have begun filtering money into your allocated accounts, this is where the next challenge lies, in sticking to the plan. If you follow the plan you will reap the rewards.

Profit First is more than just managing expenses. I know, many people can baulk at the word budget, but when you only have a predetermined amount of money you can spend on each business facet it does invite you to be ruthless with your expenditure. Reviewing expenses is a necessary evil. The review is not just about cutting expenses but reviewing each item to see if it is necessary to run your business, perhaps you are paying for two subscriptions that could be managed by one. Perhaps you could automate processes, saving you time and money. Perhaps you could negotiate a better deal by paying annually, rather than monthly. With the right strategy, you can improve the profitability and sustainability of your business.

We recommend that you review and revisit your allocations every 12 months. Business landscapes can change quickly and in order to ensure that your business is working at its fullest potential, your allocations need to reflect the changes that may be happening. The beauty of Profit First is that it is nimble and responsive. Business owners can see and feel the impacts of this methodology almost instantly. There is true Power in Profit First.

If you would like help determining your Target Allocation Percentages (TAPs), then please book a call with us. We are passionate about helping business owners to reap the rewards of their work.

4.8 Rating

Building a profitable business is not an overnight success;

it’s a journey of consistent efforts and strategic financial management. In the world of entrepreneurship, profit isn’t just a destination; it’s a perpetual path.

-Mike Michalowicz

Ready to revolutionise your business's financial approach? Join us on a journey to financial success by embracing the Profit First Methodology. Partner with us now and pave the way for a brighter financial future.

Special Offer: Register now for just $98 (normally $330)!

1st Masterclass Session: Thursday, 07 Nov 2024